Search Results for: tax

Tax Collector

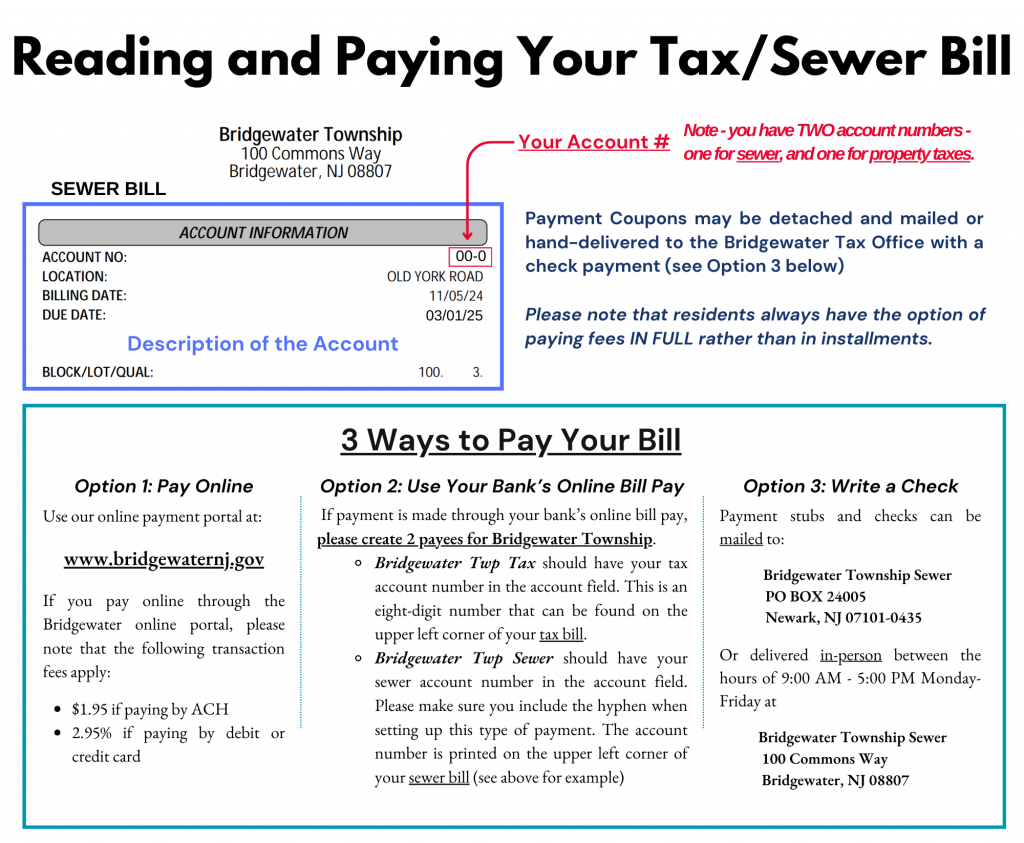

The Bridgewater Township Tax Collector is responsible for the collection of taxes, sewer utility bills, liens connections, assessments, and reconciling state reports and municipal accounts. The office prides itself on maintaining a good rapport with residents and lending institutions.

Business Hours:

Monday thru Friday: 9 a.m. – 5 p.m.

(8 a.m. to 5 p.m. during 10 day property tax grace period, not the sewer utility grace period)

2025 Property Tax Due Dates:

- February 1 **

- May 1 **

- August 1 **

- November 1 **

2025 Sewer Tax Due Dates:

- March 1 **

- September 1 **

** There is a 10-day grace period. If the 10th day falls on a weekend or a holiday, the following business day is the last day of the grace period.**

VIEW YOUR PROPERTY TAX/SEWER BILLS HERE

Tax Reduction Programs:

- Property Tax Relief Programs

- Property Tax Deduction Claim by Veteran or Surviving Spouse

- Claim for Property Tax Exemption on dwelling house of Disabled Veteran or Surviving Spouse

- Claim for Property Tax Deduction on dwelling house for Qualified NJ Resident Senior Citizen, Disabled Persons or Surviving Spouse

Property Tax Rebate Programs – Click Here

Electronic Tax Sale – Click Here

Senior Freeze Applications: https://www.state.nj.us/treasury/taxation/ptr/printform.shtml

Mortgage Escrow If the money is escrowed by a lending institution for tax payment, it is the responsibility of the homeowner to have the institution send to the Tax Office the correct bank code.

If any property is refinanced or sold to another lending institution, it is the agency’s responsibility to provide to the Tax Office the new bank code.

When a mortgage is satisfied, please contact the tax office for the removal of the bank code.

To reach the Acting Tax Collector, Blanca Lyons, please call (908) 725-6300 ext. 5143, or by email at taxcollector@bridgewaternj.gov

Tax Assessor

NOTICE: Letters to residents that are up for reassessment this year have been sent. If you misplaced your letter, please click here to view.

Property/Block and Lot Information:

Property information is readily available at the Tax Assessor’s office. Due to the large amount of information, and anticipated reliance and accuracy, it is recommended that this information be obtained in person at the office.

|

What are the duties of the Tax Assessor? Assessment Appeal Due Date: Click here for a brochure regarding Tax Appeal Hearings Annual Reassessment Program: As a state requirement of the reassessment program, each property must be inspected within a four-year cycle. Each year of our annual reassessment program the Township of Bridgewater contracts with an accredited appraisal firm to conduct property inspections in order to confirm data accuracy. Having correct data is paramount to valuation accuracy. This is also vital to maintain equity and uniformity. Our goal is to have all assessments reflect as close to true market as possible. A notice will be mailed out prior to the inspection to the homes being inspected this year.

YOU MUST CALL APPRAISAL SYSTEMS INC AT (201) 493-8530 TO SCHEDULE EITHER OPTION AND WITH ANY QUESTIONS REGARDING THIS INTERIOR INSPECTION. At any time during the year we welcome you to contact the Assessor’s office to obtain information with regard to your assessment and the reassessment function. If you have questions, please contact the office at 908-725-6300 Ext. 5121. TAX DEDUCTION PROGRAMS: APPLICATION FILING PERIOD FOR SENIOR/DISABLED AND VETERAN $250.00 Real Property Tax Deduction Programs and respective link to applications:

.* These deductions require this supplemental to accompany the application: APPLICATION FILING PERIOD FOR DISABLED VETERANS File this form with the municipal tax assessor at any time during the tax year. Partial or prorated exemption is permitted for the remainder of any taxable year from the date ownership or title to the dwelling house is acquired provided all other eligibility requirements are met. For example, where application is filed on June 1st of the tax year for exemption on a dwelling house acquired on February 14th of the tax year, the assessed value is to be prorated for taxation purposes so that 44/365th’s of the total assessment would be taxable and 321/365th’s would be exempt. Click here for Exempt Disabled Veteran Form For a presentation on the New Criteria for Disabled Veteran Exemption, please click here Property Tax Reimbursement Program (AKA Senior Freeze): Change of Address: Change of Address Request – CORPORATION, LLC, and EXEMPT OWNERS Change of Address Request – RESIDENTIAL Farmland Application Forms Application for Farmland Assessment Changes to Farmland Assessment for the Year 2019 Supplemental Farmland Assessment Gross Sales Form The Tax Assessor, Anthony R. DiRado, can be reached at (908) 725-6300 ext. 5121 or by email at taxassessor@bridgewaternj.gov. |

Municipal Services

The Department of Municipal Services is inclusive of several divisions, including Engineering, Public Works, Sewer Utility, Code Enforcement, Fire Safety, and Planning/Zoning.

This Department assists and protects all Bridgewater residents and the inherent appeal of the community in many ways including:

- Ensuring all construction within Bridgewater, both residential and commercial, is in accordance with the Uniform Construction Code of New Jersey. Purpose: To safeguard the public’s health, welfare and life safety in buildings;

- Preventing the occurrence of fires through education and compliance inspections Mission: to help prevent the occurrence of fire, protect lives and to preserve property through: Enforcement, Education, Permitting and Inspection, Plan review

- Assist and protect the public, compliance with Township Codes, investigating drainage issues, keeping soil disturbances to a minimum

- Preservation of trees

- Serving as Professional and Administrative Staff to Bridgewater Township Planning Board

- Enforcing compliance with current Zoning Ordinances

- Managing Township Capital Improvement Projects

- Keeping Tax Maps/Zoning Maps available for the public

- Managing the use, construction, operation and maintenance of the Sewer Utility

- Providing exceptional service and maintenance of Public Works structures and facilities

Contacts:

Thomas M. Genova – Director of Municipal Services

Maria Schaumberg – Project Manager

Lauren Vitti – Confidential Administrative Assistant

Engineering –

William H. Burr, IV, PE – Township Engineer

Anthony Gallo, PE, CME – Assistant Township Engineer

Kunal Dash – Project Manager

Kyle Boehme – Engineer/Project Manager

Public Works –

Richard Shimp – Superintendent of Public Works

Tyson Murdock – Supervisor/Public Works

Sewer Utility –

Thomas M. Genova – Director of Municipal Services

Richard Shimp – Superintendent Public Works/Sewer Division Maintenance

Code Enforcement –

Steve C. Rodzinak – Construction Official

Fire Safety –

Thomas E. Scalera – Fire Official/Fire Marshall

Xavier Alvarado – Fire Inspector

Planning/Zoning –

Nancy Probst – Land Use Administrator

Kevin Lewthwaite – Zoning Officer

Sewer Utility

The Sewer Utility Division is responsible for managing the use and construction of sanitary sewerage facilities throughout the Township. To date we have installed 350 miles of collection lines and 50 miles of trunk sewers. We also maintain 5 major pumping stations and 115 residential grinder pumps.

Sewer Utility Division operations are divided into four major functional groups, consisting of: Administration, Construction Inspection, Engineering, and Maintenance. Responsibilities are shared among three municipal departments: Engineering, Finance, and Public Works with support from the Building Code and Enforcement Division, and the Health Department.

Each year the Township Council approves a separate annual operating budget for Sewer Utility activities. The expense of these programs is recovered through a program of annual sewer use charges.

The Sewer Utility Division is constantly in the process of planning, designing, upgrading, and constructing new facilities. Newly constructed facilities consist of private sector development projects, which are required to include provisions for sanitary sewers, and public municipal projects for existing residents. Changes in development trends approved by the Planning Board are also evaluated to help ensure capacity within the existing Township infrastructure. As the Health Department identifies failing onsite treatment facilities the Sewer Utility Division is also advised so that alternative facilities can be evaluated and be added to the Six Year Capital Improvement Plan. Sewer Utility maintenance personnel also keep track of repairs and service calls to help aid in planning systems upgrades.

Sewer Utility Division operations include a variety of activities from general management to planning, design to construction, operations to preventative maintenance, collecting revenues to controlling expenditures, and interaction with the Township’s tax collector to ensure that all sewer users utilizing Bridgewater’s municipal sewage system are paying their fair share.

Sewer Utility Division is managed by Thomas M. Genova, Director of Municipal Services. He can be reached at 908-725-6300 Ext. 5515 or by email: tgenova@bridgewaternj.gov. Sewer Maintenance is managed by Richard Shimp, Superintendent of Public Works. He can be reached at 908-725-6300 Ext. 6000 or by email: publicworks@bridgewaternj.gov. For all sewer billing issues or to set up an account, please contact the Tax Collector’s office at (908) 725 6300 ext. 5145 or email: taxcollector@bridgewaternj.gov.

PRESS RELEASE: Bridgewater Township Council Passes Resolution Expressing Disappointment in Lack of Federal Stimulus Funds

Mayor Moench Holds First Telephone Town Hall for Residents

Bridgewater Township Clean Communities Mini-Grant Program

Bridgewater Township’s Clean Communities Mini-Grant Program is part of the New Jersey Clean Communities statewide, comprehensive, litter-abatement program created by the passage of the Clean Communities Act in 1986. The Act provides a funding source for the program by placing a tax on fifteen categories of businesses that may produce litter-generating products.

Bridgewater Township is required to implement litter abatement programs that incorporate the elements of cleanup, enforcement and education. The Act also provides guidelines on the use of funds. Municipalities and counties must file statistical reports with the New Jersey Clean Communities Council, Inc. every grant year. Statistical reports track the expenditure of funds and the progress of local programs.

Bridgewater Township conducts a fall and a spring clean up on properties throughout the township. Organizations can earn up to $500 for a clean up. The Township gives out up to 20 mini-grants in the fall and in the spring. Any group that did not receive a fall grant will be given priority in the spring. Bridgewater Township’s Clean Communities Mini-Grant Program is subject to change based on availability of funds.

Please direct all questions to Jodi Schneider at jschneider@bridgewaternj.gov or by phone at 908-725-6300 ext. 5080 or Christine Madrid at cmadrid@bridgewaternj.gov or by phone at 908-725-5750.

*Please note that Bridgewater is in the process of examining the way in which this grant is administered. There may be changes forthcoming in the Fall when we enter a new grant cycle. You can check back here for additional details.

Click Here For Application Packet

Please log into our new SDL Portal to view public data including permit information, complaints, violations, licenses & certificates and to place requests for Zoning, Code Enforcement, Fire Prevention and the Tax Assessor.

Please log into our new SDL Portal to view public data including permit information, complaints, violations, licenses & certificates and to place requests for Zoning, Code Enforcement, Fire Prevention and the Tax Assessor.