Search Results for: tax

Shop Bridgewater

Founded in 2010, Fincredit Inc. is a business solutions company focusing on merchant services and marketing.

In late 2010, our company started the development of the Property Tax Reward ProgramTM (PTRP). Under the PTRP, homeowners shopping at local participating merchants, receive rebates on sales and services in the form of property tax credits. The more homeowners shop in their town, the more property tax credits they accumulate.

Early on, our company realized that the road to developing an effective property tax reward program for the benefit of the individual resident and the business owner alike, could not be achieved without the involvement, in a leadership capacity, of local townships and their economic development entities.

For years townships have been advocating for local spending. The benefits of a thriving local economy go well beyond the obvious reasons. Lower vacancies, higher ratables, new jobs, lower property taxes are just a few reasons for shopping in town. It soon became clear to us that what prevented townships from developing a strong Shop Local program was lack of attractive incentives to town residents.

The challenge was to create a special business reward program that would be a true asset to the local business community and, at the same time, provide a strong motivation for residents to shop in town. For us, there was only one solution. Property tax credits earned on purchases of goods and services from local merchants was the best way to create an ongoing, vialble Shop Local economic program.

The response of homeowners looking for ways to lower their out-of-pocket expense of property taxes has been overwhelming. Add to this, the need of local merchants to increase their business volume and of townships to keep existing businesses from leaving while attracting new business initiatives.

For us, combining existing and proprietary, patent-pending, software was the winning formula for creating a sound infrastructure for townships to build and launch their property tax reward program.

This is a true ‘win-win’ solution for town residents, local businesses and townships. By using a township-issued property tax card, residents enjoy a direct relief on their property tax bills; the business enjoys a higher local awareness/revenues, and the township benefits from lower vacancies, more local jobs and happier residents.

To register for this program: Shop Bridgewater

FOR CONSUMERS:

Q. What is the Property Tax Card (PTC) program?

A. PTC is a Township’s economic development program which provides property tax dollars as an incentive for residents to shop in town.

Q. How does the program work?

A. A PTC (similar to a reward card) will be made available to all township residents. After they enroll in the program, residents may use the PTC and accumulate property tax dollars.

Example: The cost of a dinner for four at a restaurant participating in the PTC with a 20% property tax rebate is $200. When paying for the check (either cash or credit), just present your PTC. The tax card is then swiped and a $40 tax credit (less program fees) is generated. Rewards will be credited to your property tax bill before your next tax bill is issued.

Q. How do I obtain a PTC?

A. Please contact your township for information on how to obtain your PTC.

Q. Is there a cost to obtain the card?

A. The card is free to the participant.

Q. How do I enroll in the PTC program?

A. You can register your card online at http://www.propertytaxcard.com.

Q. I rent my house. Can I benefit from the program?

A. Yes. When you register your card, check the “Renters” box and provide your information. The Renters option will appear in the online registration form only if your township program allows renters to participate. Yearly, a check for the total rebates you have accrued will be mailed to you. A $7 check handling fee will be deducted from your accumulated rebates.

Q. I work in town but I live out of town. Can I still benefit from the program?

A. Yes. Provided the township extends the program to people that do not live in town. At registration, you would choose the option “RENT OR LIVE IN A DIFFERENT TOWN”. A yearly rebate check will be mailed to you (see answer above).

Q. Can I obtain and register multiple cards?

A. Yes. You can register as many cards as you need. If for example your household includes four shoppers, you may obtain four cards and register them all under the same address and block and lot number. Therefore your property tax bill will be credited every time any of the four cards is used.

Q. What establishments participate to the PTC program?

A. You can find a list of local participating merchants at www.PropertyTaxCard.com/Bridgewater/participants

Q. Can I use a coupon in conjunction with the PTC?

A. As a general rule, businesses do not accept multiple discount offers. However, the merchant will make that determination when joining the program. It is possible that they will allow only a portion of the discount from the coupon and honor the PTC. Again, the merchant will unilaterally make that decision.

Q. Can I return an item and get full credit?

A. Yes. Store return policies do not change. You will need to submit your rebate receipt and the PTC when returning an item for full credit. If a return takes place after funds are transferred to the Township, you will be entitled only to full store credit or to a refund of your purchase amount less the property tax rebate paid by the merchant. However, the above is subject to the store return policy. If the PTC and the rebate receipt are not produced, only store credits will be provided by the store.

Q. How do I keep track of my credits?

A. After you register your card online, you will be able to check your card(s) activity and property tax savings on www.propertytaxcard.com .

Q. What is the property tax rebate that I will be getting from stores?

A. The rebate percentage will be indicated next to the name of the participating establishment on www.propertytaxcard.com .

Q. What happens if I am registered but do not have my card at the time of purchase?

A. Our system allows you to provide your registered phone number and obtain the credit. However for partial returns and voids, you must have your card or your card number available.

FOR MERCHANTS:

Q. What is the Property Tax Card (PTC) program?

A. The PTC is a Township program which provides property tax dollars as an incentive for residents to shop in town

Q. How does the program work?

A. A township distributes a Property Tax Card (similar to a reward card) to its residents. When shopping at a local store, together with the normal payment for goods and services, the cardholder will submit their PTC. You will swipe the PTC in a dedicated processing machine that Fincredit Inc. (Program Manager) will provide. The swipe will result in a rebate on sale. The rebate is credited to the shopper’s PTC account. You, the merchant, will determine the rebate percentage when enrolling in the program. Every week, the accumulated rebates will be collected by the Program Manager from your checking account. Yearly the rebates will be applied to your customers’ property tax bill.

Q. How do I enroll my business?

A. You will be asked to fill out a 2-page form. You may also register your business on line www.propertytaxcard.com/(nameofprogram) >Business Registration on menu bar . After we process your application, we will provide you with a welcome kit including user guide on how to process transactions.

Q. What is my cost to participate in the PTC program?

A. After the initial purchase of the processing machine, if required (approx. $160 for dial-up terminal,

$230 IP terminal, $50 for a card reader, if you use our web terminal), your monthly cost is $10.

Q. What is my responsibility as a participant?

A. Your only responsibility is to honor the rebate you choose to provide to the cardholder. Rebates are collected weekly. To avoid bank fees, we require that a sufficient amount to cover the rebates is kept in the account.

Q. What is a good rebate to offer?

A. What you offer to the cardholder is entirely up to you. Rebates vary widely from business to business. A grocer may have a 35-40% gross profit, and offer 10%; an exclusive restaurant 300-400% and offer a 30% rebate. Each business will determine their rebate percentage when enrolling in the program. We require that your rebate be in line with what you normally offer in your marketing campaigns.

Q. I accept coupons. What if a cardholder presents both his card and a coupon?

A. Generally, the card as well as coupons cannot be used with any other offer. This will be expressly stated in the terms and conditions of the program when registering the card. However, you may want to offer a lower discount on the coupon and still honor the card rebate. Remember, the idea is to retain the customer.

Q. What is the advantage to participating businesses?

A. Thanks to the appeal of property tax rebates, local businesses should enjoy a higher business volume. Furthermore, continued support by the township should provide a high awareness for local businesses. An additional feature is that you will have access to email addresses of customers that used the card at your business. Finally, your business banner and website link will be featured at www.propertytaxcard.com at no extra cost.

If your township opts to get a ShopYourTown mobile App, you will have a free mobile presence. App upgrades are possible (eg reservations; take-out orders; merchandise inventory, etc)

Q. How are returns handled?

A. Your normal return policy applies. When returning an item, you will ask for their rebate receipt and card. If the return qualifies for a full cash return, you will then swipe the card in your dedicated processing machine and apply the credit that will be reimbursed to your account.

IF THE PROPERTY TAX CARD AND THE RECEIPT ARE NOT PRODUCED, ONLY A STORE CREDIT WILL BE MADE AVAILABLE TO THE CONSUMER.

Q. When a customer returns merchandise, how do I know that the PTC was used?

A. At the point of sale, you will write the name of the program on the sale receipt.

Q. Can a professional business (e.g., non-retail) owners participate in the program?

A. Yes. It would work the same way. Example: At a property closing, the lawyer participating in the program collects the card information from the client. Back at the office, the information is processed and, say, a rebate for $250, less program fees, is created and credited to your customer. The same procedure applies to a larger trade companies that have several service people going to residents’ homes.

Q. Can I offer a flat dollar discount i.e., $100 off a prepared tax return, $25 off a doctor’s visit, $500 off real estate closing, etc.

A. Yes.

Q. Can I use my existing POS system?

A. It depends on the system. If the POS system is not locked and is serviced by our processing company, it will work just fine. Some systems will work only with certain programs.

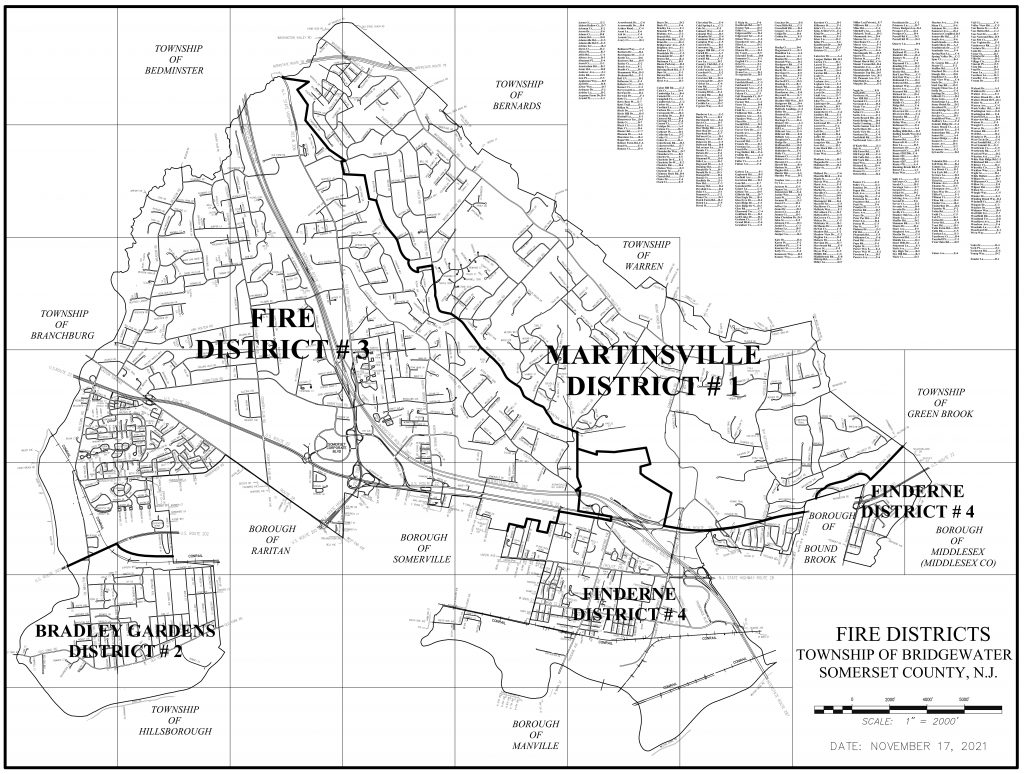

Board of Fire Commissioners Fire Districts

Please note that the Somerset County Drop Box is NOT available to be used to cast mail-in ballots for Fire District Elections.

The Board of Fire Commissioners is an elected five member board of residents that serve to provide to the taxpayers fire protection service. Bridgewater Township consists of four districts, each with five elected board members.

The board is created by law and charged with providing the equipment, apparatus and related expenses to the volunteer fire companies within their jurisdiction.

The Board of Fire Commissioners is created pursuant to N.J.S.A. 40A: 14-70. The general powers of the commission are specifically set forth in N.J.S.A. 40A: 14-81 and supplemented by various statutory sections N.J.S.A.40A:14, et seq. which are incorporated in the By-Laws of the Board of Fire Commissioners.

Directory of Departments

Important Notice

**** E-MAIL NOT RECEIVED? ****

Please be sure to check SPAM folders and other e-mail filters sometimes handled by your ISP or e-mail provider. Particularly with GMAIL GOOGLE has made improvements in their e-mail filters and we have seen an increase of Bridgewater Township emails going to SPAM folders.

You may “whitelist” appropriate senders addresses to prevent this. Please ask your provider for directions.

For security purposes, all emails to Township email addresses must contain a name, address, and phone number in order to receive a response. In addition, no email containing an attachment will be opened by Township employees without prior notification from the sender.

The following contact numbers are related to the Bridgewater Municipal Building and are sorted by extension number. Click on each bolded name to send an email to that person.

| Mayor of Bridgewater | 908.725.6300 x5000 | Matthew C. Moench |

| Contact the entire Council in one email | TellTheCouncil@bridgewaternj.gov | |

| Council President Howard Norgalis | Howard Norgalis | |

| Councilman Vice President Filipe Pedroso | Filipe Pedroso | |

| Councilman Michael Kirsh | Michael Kirsh | |

| Councilman Allen Kurdyla | Allen Kurdyla | |

| Councilman Timothy Ring | Timothy Ring | |

| Township Administrator | 908.725.6300 x5000 | Michael Pappas |

| Deputy Township Administrator | 908.725.6300 x5000 | Scott Stephens |

| Office of Constituent Relations | 908.725.6300 x5888 | Scott Maraldo |

| Township Clerk | 908.725.6300 x5025 | Grace Njuguna |

| Fire Official | 908.725.6300 x5555 | Thomas Scalera |

| Human Resources Officer |

908.725.6300 x5045 | Christine Madrid |

| Chief Finance Officer | 908.725.6300 x5110 | William Pandos |

| Purchasing Agent | 908.725.6300 x5043 | Sarah Housman |

| Accounts Payable/Escrow | 908.725.6300 x5103 | Pat DeSarno |

| Tax Assessor | 908.725.6300 x5121 | Anthony DiRado |

| Tax Collector | 908.725.6300 x5143 | Blanca Lyons |

| Director of Municipal Services and Sewer Utility Director | 908.725.6300 x5515 | Thomas Genova |

| Township Engineer | 908.725.6300 x5090 | William Burr |

| Code Enforcement Superintendent | 908.725.6300 x5565 | John Tillotson |

| Public Works Superintendent | 908.725.6300 x6000 | Richard Shimp |

| Township Planner | 908.725.6300 x5535 | Katherine Sarmad |

| Zoning Officer | 908.725.6300 x5541 | zoning@bridgewaternj.gov |

| Land Use Administrator/Deputy Zoning Officer | 908.725.6300 x5530 | Nancy Probst |

| Director of Health & Human Services | 908.725.6300 x5210 | Christine Madrid |

| Health Officer | 908.725.6300 x5205 | Kevin Sumner |

| Recreation Superintendent | 908.725.6300 x5300 | Rachel Barrett |

| Registrar of Vital Statistics | 908.725.6300 x5551 | Constance Delrocco |

| Senior Services Coordinator | 908.725.8020 | Jennifer Osterberg |

| Township Attorney | 908.526.0707 | Christopher Corsini |

| Court Administrator | 908.725.6300 x5404 | Jenni Peterson |

| Police Chief | 908.725.6300 x4034 | John Mitzak |

|

|

||

| Somerset Regional Animal Shelter | 908.725.0308 | Brian Bradshaw |

| Bridgewater Board of Education | 908.685.2777 | Robert Beers |

| Somerset County Library | 908.526.4016 x129 | Brian Auger |

Zoning Department

Click here to access the Zoning Board’s meeting agendas, minutes, and notices.

Zoning is the establishment of standards across our neighborhoods in an orderly pattern to protect our community’s health, safety, and welfare. It determines how our town’s land is used and what operations or activities may be permitted when and where. The office reviews construction application permits, it also issues utility shed permits along with patio, fence, and gazebo permits.

Questions regarding construction of additions, decks, and driveways should be referred to Zoning, as well as questions on snow removal from sidewalks.

The Zoning Officer reviews permit requests to ensure all projects and proposals conform to our ordinance standards. In addition, Zoning also investigates property maintenance issues.

The Zoning Enforcement Office is located in the lower level of the municipal building. The office hours are from 9AM – 5 PM.

Before starting any home project or development, you should check with Zoning to determine if the work requires a permit. Depending on the project, you may also require construction, plumbing, and electrical permits, but a Zoning permit is your first step.

Permits are required for the following:

- New house construction, additions

- Detached garages

- Decks, porches, or patios

- Sheds, fences, retaining walls

- Pools (above and in-ground), hot tubs, spas

- Standby generators

- Signs

If you have questions regarding the permit process or other Zoning matters, please get in touch with Roger Dornbierer at 908-725-6300 x5541.

Property owners and tenants are responsible for clearing snow and ice from sidewalks. Snow may not be moved to a cleared public roadway due to public safety concerns. Please refer to Chapter 182, SNOW AND ICE REMOVAL of the municipal code for more information.

The Zoning Officer conducts field investigations. Land use and ordinance violations are two of the areas routinely brought to his or her attention. Complaints often include inoperable or unregistered vehicles. Complaints made by residents are recorded and investigated. Occasionally, summonses are issued and the offenders are required to appear in court.

Attention: All Real Estate Agents – under our ordinance, “For Sale” signs are limited to the listed property only. Any “Open House” or directional signs off the property are allowed for the day of the open house only.

All Planning and Board of Adjustment application questions are referred to the Planning Office and specifically to the Board Secretary at ext. 5530.

The Zoning Office can be reached at (908) 725-6300 ext. 5541

The Land Use Administration Office can be reached at (908) 725-6300 ext. 5530

HOME OCCUPATIONS

Chapter 126-368 to view the ordinance on Home Occupations.

Home-Office-or-Occupation.form-2024

FENCE GUIDELINES

All fencing requires a Zoning Permit issued by the Zoning Office. Permit requires a survey showing the fence location and a picture or specifications of the style of fence. An inspection of the completed fence is only made if a complaint is made with the Zoning Office. Maximum fine for erecting a fence without a permit may be $1,000.00.

A fence is a structure. It cannot be over six feet in height. Any fence placement that may violate a property line becomes a civil issue and the township does not arbitrate any dispute. Any fence placed along a wall along a property line cannot be higher then six feet on both sides measured at ground level.

Any landscaping along any property line may augment privacy with no regulation.

Solid and Open Fence:

All fences must be installed a minimum of six (6) inches set back from all property lines and shall comply with the following:

- No portion of the fence, including face, footing, foundation, or posts, shall be installed over the property line, or into the road right of way.

- No fence shall interfere with sight distance along any portion of the road right of way or access easement.

- No fence is permitted within an existing sight triangle.

- No fence may encroach onto a public utility easement or public access easement without the written permission of the Township Engineer and a written agreement between the property owner and Township that is to remain in perpetuity for the life of the fence, and must be recorded in the Somerset County Clerk’s Office. At a minimum, a gate shall be required on one (1) side of the easement for access.

- No fence shall encroach onto a conservation easement.

Height of a fence shall be as follows:

- The maximum height of a fence is six (6) feet along the rear property line.

- The maximum height of a fence is six (6) feet along the side property line if the fence terminates no less than three (3) feet behind the front of the principal building, excluding such projections as porches, steps, bay and bow windows, patios and similar projections.

- The maximum six (6) feet height may be continued from the side property line to the principal building as long as it is no less than three (3) feet behind the front of the principal building.

In all other areas of a lot, the maximum height of a fence is 48 inches and shall contain gaps of at least 50% of the width of the solid vertical portion staggered in a manner similar to a picket fence.

Fences used to enclose non-residential electrical supply stations and mechanical facilities having energized electrical conductors or equipment shall be a maximum of eight (8) feet in height and shall be effectively grounded.

Fences that are constructed on top of or in association with a retaining wall shall be limited to four (4) feet in height and shall comply with all other applicable provisions of this Chapter.

Measurement of the height of a fence shall be as follows:

The height of a fence shall be measured from the lowest surface of the ground to the highest point of the fence throughout its entire length.

For a fence placed on top of a retaining wall, the combined structure shall be measured from the bottom elevation of the retaining wall to the highest point of the fence.

Section 196-3, DESIGN STANDARDS

Design Standards for fencing shall be as follows:

- The finished face of the fence must face the abutting property, except:

- Where the fence encloses an outdoor recreational facility.

- Where the fence is in a residential zone and where the fence abuts a commercial or industrial property.

- Fence posts may be six inches higher than the fence.

- Fence installation shall not adversely affect drainage.

- Fence shall be constructed out of material customarily used for fence construction.

- Fences or barriers surrounding swimming pools shall be consistent with the currently adopted Building Codes in the State of New Jersey.

SHEDS – GAZEBOS

All sheds require a permit. Application must include a survey locating the shed and a picture with specification sheet of the shed.

Sheds – 100 SF or less

- Requires Zoning permit only. No UCC building permit needed

- Height maximum of ten (10) feet as measured from grade to the peak

- Distance to side and rear property lines is three (3) feet only in the following zones: R-20.1, R-10.1, R-10, R-10A, and R-10B

- All other zones the minimum distance to side and rear property lines is ten (10) feet

- Follow manufacturer’s guidelines for footing or foundation

- Cannot be placed in front yard

- Height over ten (10) feet, accessory structure setbacks for each zone applies and requires a UCC building permit

- No utilities allowed without proper UCC building permits

- This is an accessory structure (maximum of two (2) per lot)

Sheds – 101 – 199 SF

- Requires Zoning permit only. No UCC building permit needed

- Height maximum of ten (10) feet as measured from grade to the peak

- Taxed

- Locate on your survey within setback for that zone

- Follow manufacturer’s guidelines for footing or foundation

- Cannot be placed in front yard

- Height over ten (10) feet, accessory structure setbacks for each zone applies and requires a UCC Building permit

- No utilities allowed without proper UCC building permits

- This is an accessory structure (maximum of two (2) per lot)

Sheds – 200+ SF

- Requires Zoning and UCC building permits

- Locate on your survey within setback for that zone

- Taxed

- Cannot be placed in front yard

- Maximum height at peak is sixteen (16) feet as measured from grade to the peak.

- No utilities allowed without proper UCC building permits

- This is an accessory structure (maximum of two (2) per lot)

Gazebos

- All gazebos require a zoning permit and a UCC building permit

- Locate on your survey within setback for that zone

- Taxed

- Cannot be placed in front yard

- Maximum height at peak is sixteen (16) feet as measured from grade to the peak

- Utilities require UCC building permits

- This is an accessory structure (maximum of two (2) per lot)

Please note that Bridgewater Township does not maintain copies of property surveys. Each property owner is responsible for obtaining their own survey.

PATIOS & RETAINING WALLS

Patio permits require a survey show the location of the patio and showing the area in square feet. That area is subject to the total improved lot coverage according to the Zoning Chart for that zone.

Patios cannot be closer than five (5) feet to side and rear property lines.

Landscape Retaining Walls require a Zoning Permit. The height of the wall is the distance it must stay from a property line. An example is a two-foot wall must remain a minimum of two feet from property line. The application requires the wall must be located on a survey.

Patios and retaining walls that are part of a Building Permit like for a pool, do not require a separate Zoning Permit. Retaining walls over four (4) feet require a UCC building permit. The Code Enforcement Office inspects them.

Department of Engineering

Overview

The Engineering Division deals with a wide range of activities. Our main function is to assist and protect the public by reviewing development applications and monitoring construction for compliance with township codes and conditions of approval. We also work on township improvement projects, investigate and respond to a wide variety of questions and concerns such as construction, drainage, property surveys, street light outages, traffic, utilities, etc.

Available in our office are the official tax maps and zoning maps for your review or purchase. Soil Disturbance permits for disturbances greater than 5,000 sq ft and Road Opening permits are also available in our office or online.

Click here for the Soil Disturbance permits or click here for the Road Opening permits.

Tree removal on private property is governed by Township Ordinance.

• Click here to view this ordinance

• Click here to access and download the Tree Removal Application

Please contact the Engineering Department by phone at (908) 725-6300 ext. 5500 if you have any questions.

CALL BEFORE YOU DIG

The federally mandated, national phone number, 811, helps prevent you from unintentionally hitting underground utility lines. Before you begin projects that involve digging, dial 811 to locate underground electric, gas or other utility lines. Digging without this information can cause power outages, and it’s extremely dangerous. Simply tell the 811 operator where you’re planning to dig and what type of work you will be doing, and your local utility companies will be notified. Within a few days, they will mark the location of underground lines.

The federally mandated, national phone number, 811, helps prevent you from unintentionally hitting underground utility lines. Before you begin projects that involve digging, dial 811 to locate underground electric, gas or other utility lines. Digging without this information can cause power outages, and it’s extremely dangerous. Simply tell the 811 operator where you’re planning to dig and what type of work you will be doing, and your local utility companies will be notified. Within a few days, they will mark the location of underground lines.

Please call at least three days in advance to avoid unnecessary delays to your project. Know what’s below – Call before you dig!

For more information, visit http://www.call811.com.

Vital Statistics

THE OFFICE OF VITAL STATISTICS DURING COVID-19 CRISIS

The Office of Vital Statistics is up and running. We are here to assist with the majority of our daily functions via mail, email or fax.

The best way for you to reach us is via email as follows:

Connie Delrocco cdelrocco@bridgewaternj.gov

Vilma Day vday@bridgewaternj.gov

To reach us via mail:

Attention: Office of Vital Statistics

100 Commons Way

Bridgewater, NJ 08807

To reach us via telephone:

(908) 725-6300

Connie Delrocco: Ext. 5551

Vilma Day: Ext. 5201

THE OFFICE OF VITAL STATISTICS

SERVICES:

- Register Vital events including Births, Marriages & Deaths

- Issue Marriage Licenses

- Issue Certified copies of Marriage, Birth & Death Certificates

- Issue Amendments to Marriage, Birth & Death Certificates

- Maintain copies of all vital records where event occurred in Bridgewater Township

- Corrections to vital records can be submitted to the State Department of Vital Statistics and Registry (where applicable)

MARRIAGE LICENSES:

- Applications for marriage/civil union are taken in the Municipality where either applicant lives

- Applications are by appointment only (908) 725-6300 ext. 5201, 5551

- A witness, 18 years or older must be present, proper ID is required (Valid driver’s license/ Passport/ State/Federal ID

Required Documents when applying for a Marriage/Civil Union License

- Proof of Identity:

- Valid driver’s license/ Passport/ State/Federal ID

- Proof of Residency:

- Valid driver’s license / utility bill / lease / tax return

- Name and Birth place (country or state) of both sets of parents (Maiden name of Mother)

- Name, address and phone number of the person performing the ceremony

- Name of place, and city where event will take place

- $28.00 payable in cash, check, or money order

- Death certificate or divorce papers, if applicable

- Social Security Number

Additional information regarding marriage of civil unions can be found here

CERTIFIED COPIES OF A VITAL RECORD

This office, upon request, supplies certified copies of non-genealogical vital records of all births, deaths and marriage/civil unions where the event took place in Bridgewater Township.

Each copy is $25.00 and $2.00 for each additional certified copy.

Cash (exact change) check or money order made out to “Bridgewater Township”. We do not accept credit/debit cards.

To request a certified copy of a vital record by mail, fill out an application, include driver’s license with current address (cannot send to P.O. Box) and include a check or money order for $25.00 for the first copy and $2.00 for each additional copy. Please include a self addressed stamped envelope and mail to:

Bridgewater Health Department/Vital Statistics

100 Commons Way

Bridgewater, NJ 08807

Click here to download “Request for Certified Copy of a Vital Record” form.

DOMESTIC PARTNERSHIPS

WHAT IS A DOMESTIC PARTNERSHIP AND HOW CAN I REGISTER FOR ONE?

A domestic partnership is for couples of the same sex OR couples that opposite sex and who are both 62 years of age or older. Couples must meet certain requirements.

The Affidavit of Domestic Partnership is not available as an electronic form. It is a carbon copy form that must be obtained from our offices.

View all Domestic Partnership requirements and information here.

Affordable Housing

Bridgewater Affordable Housing

Bridgewater Township has maintained a successful affordable housing program for many years, supporting the development of over 1,400 affordable units across a variety of housing types, including single family homes, multi-family rentals, and special needs units. There are two primary components of this program – affordable housing units for sale or rent, and a housing rehabilitation program. Township funding for affordable housing units come from development fees collected by the Affordable Housing Trust Fund.

RENTING OR BUYING AN AFFORDABLE HOUSING UNIT IN BRIDGEWATER

There are numerous affordable for-sale and rental properties within the municipality. Click here to apply to rent an affordable housing unit in Bridgewater, or click here to apply to buy an affordable housing unit in Bridgewater.

Bridgewater Township Housing Rehabilitation Program Application

What is it all about?

The Township of Bridgewater Housing Rehabilitation Program is designed to assist eligible residents with funding for major and minor housing rehabilitation to their principal place of residence.

This brochure provides a brief description of eligibility criteria, the application process and procedures.

So How Does the Program Help?

The program is designed to provide assistance based on the Program Building Inspector’s determination of what eligible items are needed and does not guarantee the maximum assistance.

If eligible, a 100% property rehabilitation Deferred Loan will be made available on a First Come, First Served basis. A lien will be placed on your home and recorded with your property deed. This Loan (not to exceed $24,000) shall be forgiven ten (10) years from the date it is recorded at the County. During the ten (10) years, if you should transfer title or rent to someone for any reason, you, your heirs, executors or representative, must notify the Township and repayment must be made within thirty (30) days.

Who is Eligible?

- The applicant must be a resident of Bridgewater Township.

- The applicant must be the owner of the property and the property must be the principal place of residence.

- The Building cannot contain more than one (1) rental units and the principal unit must be owner occupied. All rent received must be declared as income by the applicant.

- The annual GROSS income (amount prior to taxes) of all persons residing in the applicant’s household must not exceed the maximum income level established by State Guidelines. These limits are subject to change annually.

- Property taxes must be current.

- The building must not be utilized for any purpose other than residential use.

Find the number of persons residing in the household to obtain the maximum income allowed. Subject to change without notice. For Households over 8 call Rehabco at 732-477-7750.

|

# of Persons in Home |

Maximum Allowed Income |

|

# of Persons in Home |

Maximum Allowed Income |

|

1 |

$75,936 |

|

5 |

$117,158 |

|

2 |

$86,784 |

|

6 |

$125,837 |

|

3 |

$97,632 |

|

7 |

$134,515 |

|

4 |

$108,480 |

|

8 |

$143,194 |

ELIGIBLE Rehabilitation and Improvements are:

Major Repairs or Replacements:

- Roof

- Heating System (includes hot water heater)

- Plumbing (includes wells, sewer, and water connections)

- Electrical

- Sanitary Plumbing (including septic systems)

- Weatherization to reduce energy consumption

- Load Bearing structural damage

- Handicap facilities (documentation required)

- Stove (ONLY when a safety hazard exists)

Minor Repairs or Replacements:

- Minor painting

- Masonry

- Gutters and leaders

- Drywall and flooring

- Fixtures

- Minor Carpentry

- Repair Driveways and sidewalks

INELIGIBLE Rehabilitation and Improvements are:

- Custom Painting

- Cosmetic Luxury Fixtures

- Purchase of appliances not required by local code

- Acquisition of land

- Landscaping

- Custom tile

- Retention walls

Next Steps:

If after reading this site, you believe you are eligible for assistance, the first step is to completely fill out and return the Application along with all the documentation requested. Incomplete applications and/or missing documents will result in delaying your eligibility.

Applications are logged in order of the date a complete application is reviewed and approved and will be served on a First Come, First Served basis.

If your application has been on file for more than six (6) months when it reaches the top of the Application Logbook, your eligibility must be re-verified based on the requirements at the present time. If determined eligible, an appointment will be scheduled for an electrical inspection and a property inspection. You, or an adult representative, MUST be present for both inspections. A Work Write-Up for rehabilitation work will be prepared based upon the results of these inspections. A copy of the Work Write-Up will be forwarded to you for your review and comments.

The Program Building Inspector and the Homeowner will monitor the construction work in order to determine compliance with the Rehabilitation Contract. All work must be approved by the applicable Borough Inspectors as well as the Program Inspector prior to the contractor receiving payment.

Have any Questions?

If you require assistance in completing the related forms or need answers to any questions, please contact the Program Staff at:

44 East Water Street, Toms River NJ 08753

Phone: 732-477-7750

Fax: 732-920-9649

Email: rehabco@aol.com

Website: rehabconj.com

AFFORDABLE HOUSING RESOURCES

- BWT Resolution 25-01-30-068

- Bridgewater 1-30-25 DCA Number Assessment

- MIDPOINT REVIEW & 2020 Annual Unit, Trust Fund, and VLI Monitoring

- HOUSING ELEMENT AND FAIR SHARE PLAN

- Affordable Housing Ordinance

- JUDGMENT OF COMPLIANCE AND REPOSE

- SETTLEMENT AGREEMENT WITH FAIR SHARE HOUSING

- FAIR SHARE HOUSING CENTER AND GENERAL HISTORY OF MT. LAUREL LITIGATION

Sewer Utility

The Sewer Utility Division is responsible for managing the use and construction of sanitary sewerage facilities throughout the Township. To date we have installed 350 miles of collection lines and 50 miles of trunk sewers. We also maintain 4 major pumping stations, oversee 13 meter stations and 135 residential grinder pumps.

Sewer Utility Division operations are divided into four major functional groups, consisting of: Administration, Construction Inspection, Engineering, and Maintenance. Responsibilities are shared among three municipal departments: Engineering, Finance, and Municipal Services with support from the Building Code and Enforcement Division, and the Health Department.

Each year the Township Council approves a separate annual operating budget for Sewer Utility activities. The expense of these programs is recovered through a program of annual sewer use charges.

The Sewer Utility Division is constantly in the process of planning, designing, upgrading, and constructing new facilities. Newly constructed facilities consist of private sector development projects, which are required to include provisions for sanitary sewers, and public municipal projects for existing residents. Changes in development trends approved by the Planning Board are also evaluated to help ensure capacity within the existing Township infrastructure. As the Health Department identifies failing onsite treatment facilities the Sewer Utility Division is also advised so that alternative facilities can be evaluated and be added to the Six Year Capital Improvement Plan. Sewer Utility maintenance personnel also keep track of repairs and service calls to help aid in planning systems upgrades.

Sewer Utility Division operations include a variety of activities from general management to planning, design to construction, operations to preventative maintenance, collecting revenues to controlling expenditures, and interaction with the Township’s tax collector to ensure that all sewer users utilizing Bridgewater’s municipal sewage system are paying their fair share.

For Sewer maintenance issues, contact the Bridgewater Department of Public Works at (908) 725-6300 ext. 6000 or email publicworks@bridgewaternj.gov.

For emergencies during non-business hours, please call (908) 722-4111 ext. 0

For all Sewer billing issues or to set up an account, please contact the Tax Collector’s office at (908) 725 6300 ext. 5145 or email taxcollector@bridgewaternj.gov.

For all other Sewer Utility business, contact Thomas M. Genova, Director of Sewer Utility at (908) 725-6300 ext. 5515 or email tgenova@bridgewaternj.gov.

Please log into our new SDL Portal to view public data including permit information, complaints, violations, licenses & certificates and to place requests for Zoning, Code Enforcement, Fire Prevention and the Tax Assessor.

Please log into our new SDL Portal to view public data including permit information, complaints, violations, licenses & certificates and to place requests for Zoning, Code Enforcement, Fire Prevention and the Tax Assessor.